QuickBooks Online conflicts

Solution No. 697

The following list common QuickBooks Online conflicts our users have encountered, and those documented by our Support Team. Please find the conflict in the table below, then click the go to link for help in solving it!

| |

Conflict message

|

| Go to |

Business validation error: you must fill out at least one split line. |

| Go to |

You and XXXX were working on this at the same time. XXX finished before you did, so your work was not saved.

|

| Go to |

Duplicate Document Number Error: You must specify a different number. This number has already been used. |

| Go to |

Invalid reference ID. |

| Go to |

Account period closed. |

| Go to |

QuickBooks International configuration issues. |

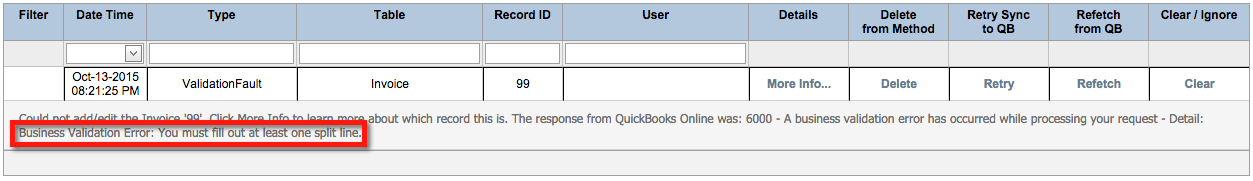

This QuickBooks Online conflict occurs when you try to sync a transaction with QuickBooks where the transaction has no line items. If you encounter this conflict, this is what you'll see (click to enlarge):

In order to correct this conflict, ensure that a line item is added to the transaction, then save the transaction.

You should now be able to proceed with your sync as normal!

Stale object error[top]

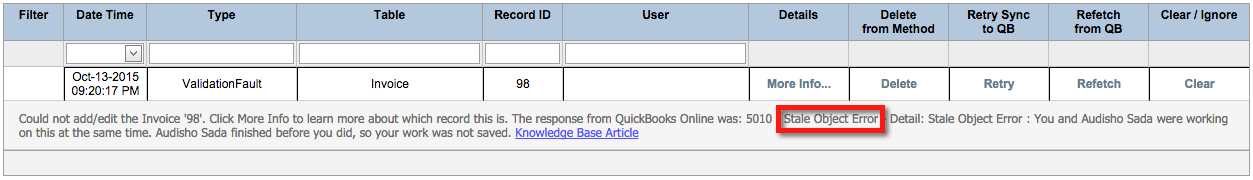

This QuickBooks Online conflict occurs when the item you were working on in Method (Invoice, Estimate, Customer record, etc.) was updated in QuickBooks Online before you completed your work. If you encounter this conflict, this is what you'll see (click to enlarge):

In order to correct this conflict:

In order to correct this conflict:

- Navigate to QuickBooks > Synchronize > Full synchronization

- Click Sync now.

In a full sync, sometimes the transaction will be updated with both lines (the one entered in QuickBooks and the one entered in Method). It is important for users to manually double check line items after the sync takes place to ensure there are no duplicates or incorrect information.

Duplicate document number error[top]

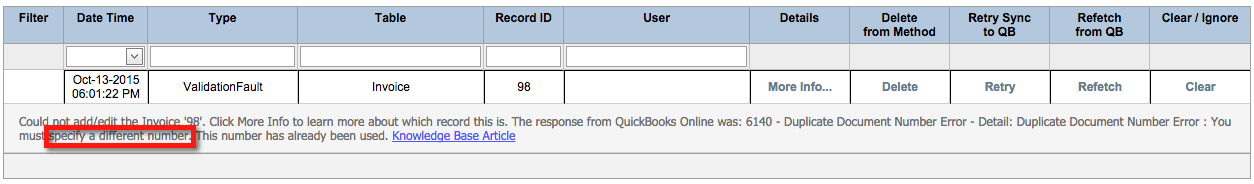

This QuickBooks Online conflict occurs when "Custom transaction numbers" is checked in QuickBooks Online. QBO requires each transaction to have a unique transaction number associated with it. If you encounter this conflict, this is what you'll see (click to enlarge):

In order to correct this conflict:

In order to correct this conflict:

- In your QuickBooks Online account, navigate to the Company menu and choose Preferences.

- Select from the following:

- Sales Form Entry > Custom Numbers, or

- Vendors & Purchases > Purchase Orders

- Uncheck the Custom transaction numbers checkbox.

- Click Save.

- Next, navigate to the transaction that did not sync.

- Deletethe existing transaction number, then save the transaction.

The next time you sync, QuickBooks Online will automatically assign that transaction a new, unique number.

You should now be able to proceed with your sync as normal!

Invalid reference ID[top]

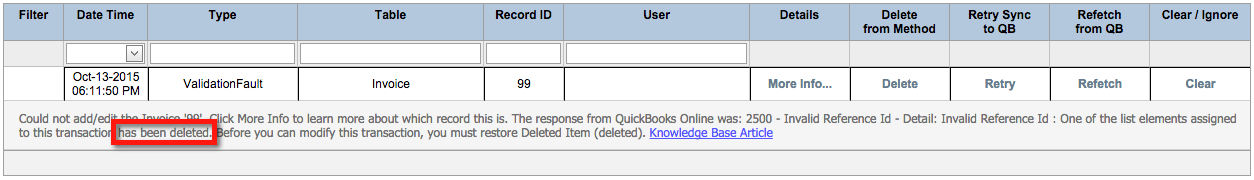

This QuickBooks Online conflict occurs when a related transaction or item has been deleted. For example, Bob has 4 items in his QBO and Method accounts (which have been previously synced). Bob marks one of the items inactive in QuickBooks, and then creates an invoice in Method using all four items. When he clicks Save, the invoice is synced to QuickBooks, but the inactive item is not yet synced to Method. That's when Bob encounters this conflict. If you encounter this conflict, this is what you'll see (click to enlarge):

To correct this conflict, do one of the following:

To correct this conflict, do one of the following:

- Mark the item as active in QuckBooks Online

- Conduct a "changes only" sync in Method (QuickBooks > Synchronize > Changes-only synchronization) to update Method with the item changes

- Remove the item from the invoice.

If these steps do not fix the conflict, please contact Method Support or consult the Forum.

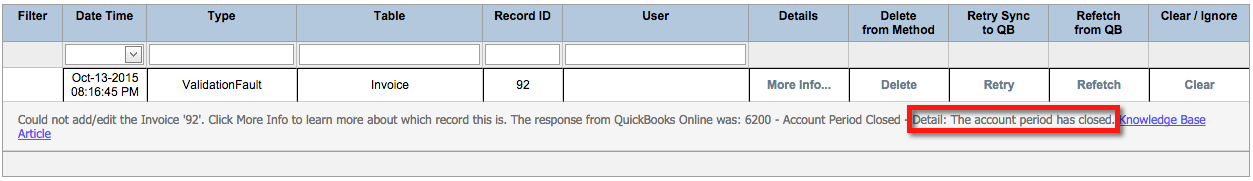

Account period closed[top]

This QuickBooks Online conflict occurs when a transaction is edited in Method, but the accounting period has already closed in QuickBooks Online. When the transaction is synced, you will receive this conflict. If you encounter this conflict, this is what you'll see (click to enlarge):

In order to clear this conflict you will need to take one of two steps:

In order to clear this conflict you will need to take one of two steps:

- Temporarily change your accounting period in QuickBooks Online so the transaction isn't in conflict with the closing date, then perform another sync. Once the conflict clears, change your accounting period back to its original settings. For more information on changing your accounting period in QuickBooks Online, please refer to this Intuit Help Article.

Changing closing dates in this way is not an accounting best practice, and as such anyone trying to make these changes will require administrative privileges in QuickBooks Online.

- You can also use the refetch option to clear this conflict. This will undo any changes that were made to the transaction before the last sync.

If the changes absolutely must be made, refer to the first possible solution.

Once one of these steps has been taken, you should be able to sync as normal.

QuickBooks International configuration issues[top]

There are currently known configuration issues when working with a non-U.S. QuickBooks account, which can result in validations faults.

Shipping

If you are attempting to add a shipping cost to an invoice, you must first ensure that shipping is enabled in your QuickBooks account.

- Go to your QuickBooks account

- Click Settings > Sales

- Ensure that Shipping is On

Discounts

If you are attempting to add a discount to an Invoice, you must first ensure that discounts are enabled in your QuickBooks account.

- Go to your QuickBooks account

- Click Settings > Sales

- Ensure that Discounts are On

[top]

| Created on | Oct-08-2015 |

| Last modified by | Caleb J. on | Mar-02-2016 |